On March 10th Manturov, Russia’s industry minister, said Russia had decided to suspendfertilizerexports temporarily. Russia is the world’s leading producer of low-cost, high-yield fertilizer and the world’s second-largest potash producer after Canada. While Western sanctions have not yet hit Russian fertilizer companies, more restrictions are likely in the future. The sanctions against Belarus, approved by the European Union on March 2nd, already include a ban on exports of potash and other products to EU countries. Global potash contracts are at their highest since at least 2008.

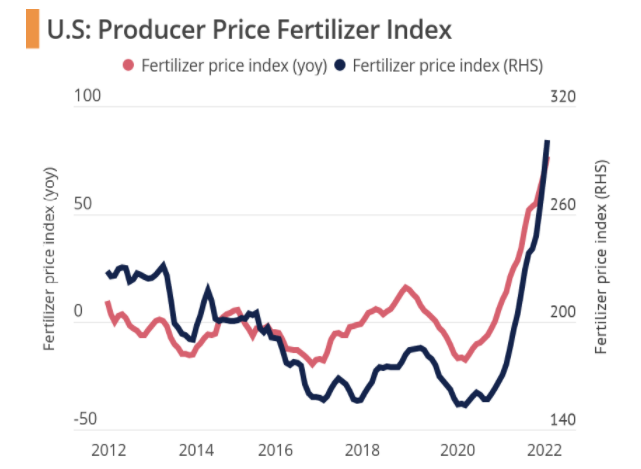

The conflict is expected to push up fertilizer prices, which remain high:

Russia is the world’s largest exporter of fertilizer, accounting for about 20 percent of global supplies. Russia and Belarus account for about 40 percent of global potash exports. China, Brazil, and India are the main demand side. Potash contracts in China and India are locked in at $590 a tonne in 2022, up to $343 a tonne from a year earlier, a 10-year high. Industry insiders believe that China, India supply time overlap, coupled with strong demand for potash in Brazil, the future price or high. In addition, potash transportation is mainly by sea, and the uncertainty of the situation in Ukraine and Russia may increase the cost of shipping.

Arlan Suderman, the chief commodity economist at StoneX, a research firm, points out that North America may face a tightening of fertilizer supplies before the start of the growing season, which could lead to a drop in crop yields that could affect global production throughout the year. Ken Seitz, interim chief executive of Nutrien, the world’s largest crop nutrition company, has hinted that farmers may start using less fertilizer as prices rise.

Fertilizer analyst Alexis Maxwell of Bloomberg said the fall in supply from Russia and Belarus would hit northern agricultural markets first, that’s because their main season for fertilizer is in the second quarter. Meanwhile, South American producers are heavily dependent on Russian fertilizers, which have seen a sharp jump in daily purchases by Brazilian customers, according to industry sources.

On March 2, Brazilian President Luiz Inacio Bosonaro proposed lifting the ban on mining in the virgin forest of the Amazon to make up for a possible fertilizer shortage caused by tensions between Russia and Ukraine, according to CCTV News. Brazil, a big agricultural country, imports 80 percent of its fertilizer each year, more than 96 percent of its potash, and Russia is its main source of fertilizer and potash. A new study from 2021 in Brazil has found potash deposits in the Amazon basin in the north of the country, with estimated reserves of about 3.2 billion tons.

Huanqiu.com also reported that to ensure that Russia maintains fertilizer supplies during the sanctions period, Indian government and banking sources said recently that, one plan is to allow Russian banks and companies to open Indian rupee accounts with some state-owned banks for trade settlement as part of a barter system that would bypass Western sanctions, this has caused resentment on the part of the sanctioning authorities.

In the United States, the Attorney General of Iowa has commissioned a market study into the “unprecedented” rise in fertilizer prices, visas, the head of the United States Department of Agriculture, warned fertilizer companies and other farm suppliers not to use the “unfair advantage” of the conflict in Ukraine to drive up prices.

Matt Arnold, an analyst at investment firm Edward Jones, thinks the world’s top crop nutrition suppliers, such as Canada’s nutrient, can ramp up production of potash as a response and could benefit if tensions rise. But it is unclear how much more North American suppliers will be able to produce this year, or how many months of new capacity will be available for retail use when the North American crop season is over.

If you have any other questions or needs, please contact us by the following ways:

whatsapp: +86 13822531567

Email: sale@tagrm.com

Post time: Mar-31-2022